Should the American dream now be called the American college debt nightmare? Some 40 million Americans will be in debt as that is the cost of education these days. The economic facts are indisputable:

- Outstanding student college debt totals $1.2tn in the US

- The cost of a private non-profit four year college institution has risen by 267%, over the last 30 years

- The cost of a public four-year college institution has risen by 357%, in the same time frame

- The average student loan debt for graduates stands at $26,000 (Guardian 2013)

A staggering 1 out of 10 Americans carry student college debt – that is 37 million individuals.

It is very much a generational burden and for the first time in history students are having to ask whether a college degree is worth the money they will have to borrow to pay for it. A staggering 1 out of 10 Americans carry student college debt – that is 37 million individuals. However, debt can be paid off and if students get their dream job then they will be in credit in no time – right?

Ok, so let’s look at best case scenarios first. Let’s say that you are in the 47% of recent graduates that manage to secure work. Unfortunately you will be looking at a moderate interest rate – around 6.8% in fact. If you have a nice job with an average income then you will feel relatively secure. That means you will be looking for your own home, perhaps a car, and you will need a social life of some sort to stay in touch with college pals and work colleagues.

If you can afford to pay back $200 a month then your debt will be paid off in 18 years and 3 months time. A more realistic payment is $150 a month and in this case you will have your debt paid off in 42 years and 8 months (ConsolidatedCredit 2013). That is practically a lifetime! Not to mention the fact that you will have paid double what the degree was supposed to cost initially because of interest accrued. If you have children you will probably be helping them with their college fees and debt by this time as well.

The worst case scenario is that you are one of the 53% of recent graduates who are unemployed or jobless.

The worst case scenario is that you are one of the 53% of recent graduates who are unemployed or jobless. Any setbacks like these will only add to the college debt and put you emotional wellbeing, zest for life and confidence under severe pressure. Should we really be putting this much financial responsibility on the guardians of our nation’s future? Watch the depression stats to see a spike in those reflecting what we are putting out vibrant young adults through at a critical time in their lives.

The final worst of the worst case scenarios facing our students are those heading into the medical profession. In a sample of 2,355 medical students in 2010-2011 62.1% of the anticipated debt above the $150,000 threshold (Science Daily 2013). Just to put that in perspective these students upon graduating have spent exactly the same as they would have on a brand new Audi Cabriolet convertible priced at $44,500 combined with a 2 bedroom house in Florida with lovely gardens priced at $99,900.

A physician’s income is not slight but it is certainly not in keeping with the inflation of tuition fees and debt. These graduates will pay between 8 and 15% of their income on managing debt. Medical education is becoming less and less affordable for students, as well as their families and this is a profession that America simply cannot do without. Medical student debt has reached a critical point.

This is debt America reality. College costs will be with you for a large portion and in some cases MOST of your life! If you are wondering whether a college education is worth it you now know the weight of the decision you are making. This is not the climate for going to college on a whim, because your parents expect you to or because you cannot think of anything better to do.

This decision will have an effect on your financial standing for many many years to come so choose wisely. Think about it as a purchase. Imagine the average $26,000 of debt students fork out for their college degree and ask yourself if you are happy with that exchange.

Do you know what you are buying?

Do you know if career prospects are good for this degree choice?

Do you know if the college has a good reputation with students?

Ask as many questions as you need to because you are probably about to make the biggest single purchase of your life!

Use our college comparison tool to determine the impact of college debt on your choice of college and profession

Sources Used:

Chris Williams (2013) The American dream should really be called the American debt. The Guardian, Tuesday 27th August 2013.

American Medical Student Association (amsa) (2013). Medical Student Debt.

Science Daily (2013). High Debt Load Anticipated by Medical Students; African-Americans Most Affected.

Use College Comparison Tool to Compare Your College Choices Now!

Hellen says

College debt is the worst nightmare for any college student. Students should come up with ways to make money while still studying. If you are going to survive then you definitely need a job. However, if you are looking for ways to make money part time, there are a number of ways you can do this:

1. Find a part-time job- waiter, baby sitting,

2. Bartending, Delivering Pizza, or waiting tables

3. Share your skills- football coaching, tutoring

4. Be a caretaker.

5. Find a campus job for example working in the library

6. Help Students with their assignments: You can do assignments for other students on campus for money or sign up as a writer in academic writing websites like essaypeer.com

Dana Boyd says

It really is very sad to see when a graduate gets stuck on heights of student debts. This shouldn’t be the case.

It is wise to learn as much as you can about different incentives you can get academically through your school or the government. Look into scholarship grants where you can make your efforts count. Studying on time payments can also reduce your total loans eventually. Keep looking for different incentives that can lower your loans because most of the times students just fail to give time in doing research about their loan programs.

–Business Synergy

Santanu says

This is a very good case study. College debts are very big burden in case you have not planned how to get rid of the same asap. Thanks for sharing this great article.

Joe says

The cost of college fees and student accommodation is crippling many throughout the States. It is important that students take time to decide exactly what they want to study and what type of career path that they want to undertake.

Amos M says

I agree this burden for students is becoming a world wide concern. I agree that this is a generational burden and students are indeed asking whether a college degree is worth the money they will have to borrow to pay for it.

Scotty says

Great share. Being in debt is definitely a killer. One should find the balance between earning money, studies, and paying their debt.

Amos M says

This is great finding. Actually this is true. Soo much debts uncured on college level that it’s sad. Worse still, there is no guarantee of a good job.

Hix Insurance says

Great Article. I think it is disappointing that in order to get education which will most probably determine your future you have to be in debt. It is sad and quite a big burden to students.

Ephantus Murimi says

Jobs are not readily available as it used to be, the solutions to this problem is that the student who are joining collages should be having good research of the courses that are being offered at the institutions.

Nice Article, Very Educative and informative.keep up the good work that you are doing.

monica says

I think this is the case in every country. College debt has been contributed by lack of jobs to graduates who have been granted loans by the Higher Education Loans Board. If the government does not provide job opportunities, the debt is expected to still increase. A good insight.

cate says

Education is basic need for our children and it can be so disappointing to get it and pay for it for the rest of your life, the government needs to do something about this crazy debts. Thank you for sharing this, it has opened some “eyes”.

viki debbarma says

College debt has also become so common in india….as many of the students are facing problems with the raising of fees price. Thanx for the post.

Demi says

College costs absolutely are too high, I know many people who graduated with insane loan amounts to pay back and most cases their salaries don’t even come close to justifying amount of debt.

Erick says

College debt is becoming a huge problem in the U.S. especially with tuition costs raising almost every year. Students have to be very selective with lenders as some have more favorable terms for students than others. We’ve created a little loans guide to help out.

quest bars says

May I simply just say what a relief to find an individual who truly knows what they’re talking about on the web.

You definitely understand how to bring an issue to light and make it important.

More people really need to check this out and understand this side of your story.

It’s surprising you’re not more popular since you definitely have the gift.

Carrie says

Very well said (written). However, as many are well aware, taking on any debt is a balance. One must really consider whether its worth it in the end. Of course, that doesn’t mean that its ok for lenders to take advantage of potential students. Such is life.

Mary says

Debts for the students in collages and university graduate are becoming more and more burden to the students who are graduating recently. Jobs are not readily available as it used to be, the solutions to this problem is that the student who are joining collages should be having good research of the courses that are being offered at the institutions and avoid the pressure of others. This will help to avoid the worst case scenario and one will be able to get a well paying job afterwards and have an easy time paying back the debts. Also the student should be creative enough to start their source of income when they are in school and avoid carrying burden of debts from time to time and this will help to cater for the basic wants of the student.

Jones says

Great Article. I think it is disappointing that in order to get education which will most probably determine your future you have to be in debt. It is sad and quite a big burden to students.

jack says

Absolutely great article on this menacing situation of student debt. While many have been calling for debt forgiveness to help settle this score, others have a problem with burdening the taxpayer with the responsibility to pay back loans that they are neither responsible for, nor benefit directly from. What is needed is simplification and better access to information regarding student loan debt, including information on consolidating debt, and increasing students’ information to both school’s default and graduation rates.

amandascott says

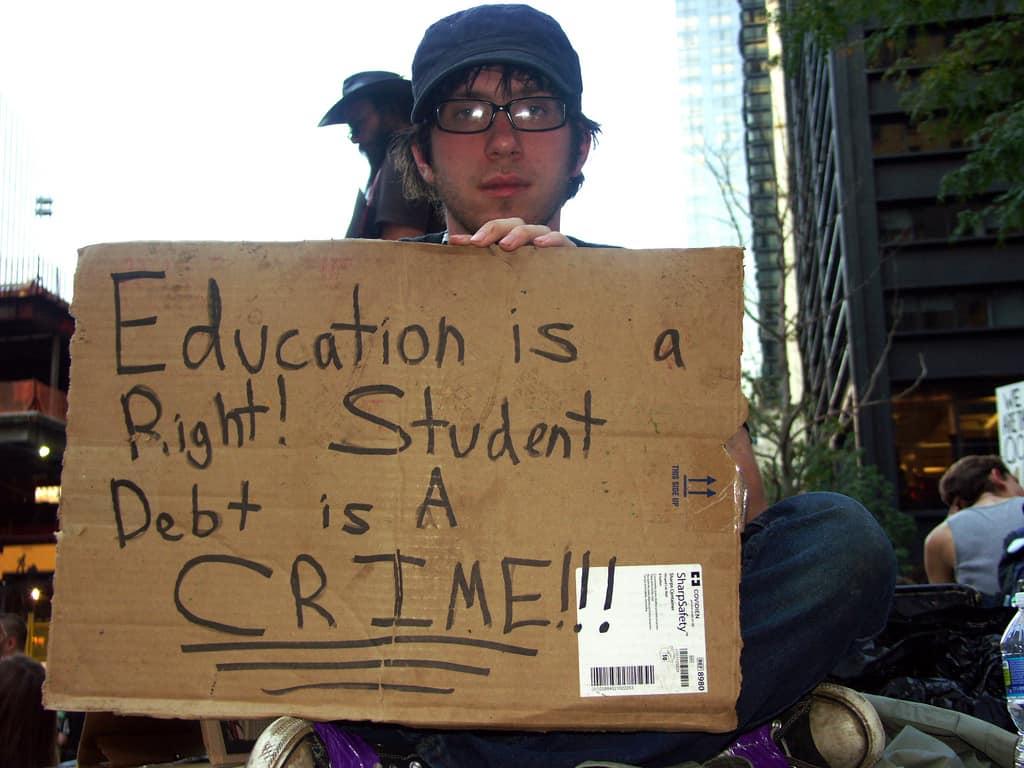

“Education is a right, Student loan is a crime” a very well quote mentioned by that student!! The way American students are suffering from paying off student loan is truly stressful…I think it would be effective for all

Barry Moran says

This is a very unique and genuine post that deserves to be brought to the notice of the authorities. I am sharing this over Facebook to ensure this gets coverage. Please make this a movement and we can actually see significant changes in at least two years from now. As for students today, the easiest way to make money would be to start an online business and generate leads that work towards getting them revenue.

Willie Prescott says

“Education is a right, Student loan is a crime” a very well quote mentioned by that student!! The way American students are suffering from paying off student loan is truly stressful. I really enjoyed learning college debt best and worse case scenario by reading such blog post. It’s definitely a great informative sharing.

Same day loan says

Glad to read your post, thanks for sharing and hope to see new post soon which will help me again in solving my queries

richard thompson says

I think it is sad that so many people come out of college with so much debt. It is absolutely crazy! It is also just so crazy that tuition can be that much. There are many places like Utah that offer cheaper tuition rates. An expensive school isn’t always the very best option.

Jeff says

Going to college doesn’t give you a free pass to any job in your field. You have to be able to demonstrate that you have a strong drive and passion for what you do.

masonliam001 says

Actually I think this is among the most vital information for me. And i am glad reading your article. But want to remark on some general things, the web site style is ideal, the articles is really excellent. Thank you for sharing with us. I think it would be effective for all. Good job, cheers! invites you to read

Ravindran Gopal says

I was very pleased to find this site and wanted to thank you for this great read!! I am definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you post.

alexzandra562 says

Actually I think this is among the most vital information for me. And i am glad reading your article. But want to remark on some general things, the web site style is ideal, the articles is really excellent. Thank you for sharing with us. I think it would be effective for all. Good job, cheers! invites you to read

forklift says

Actually I think this is among the most vital information for me. And i am glad reading your article. But want to remark on some general things, the web site style is ideal, the articles is really excellent. Thank you for sharing with us. I think it would be effective for all. Good job, cheers! invites you to read

Donald Quixote says

Yes it can be very expensive, but individuals who went to private schools took on huge amounts of debt and then left into a poor market are not as much victims as they are fools. You cannot simply protest in order to find a job and I don’t feel bad for you as it was your decision to take out the debt. Would not the same principle apply if I lost my money in stocks? Do I get a refund?